7 Sep, 2023

Understanding Transaction Costs in E-commerce Startups

Jeroen

Jeroen, Founder Startup Finance

Understanding the True Cost of Payment Methods for Platforms

One common scenario that arises in e-commerce startups is the issue of transaction costs. For instance, let's consider the popular Dutch payment method, Ideal, which charges 29 cents per transaction. As a platform, you have two options when it comes to these costs - either pass them on to your suppliers or customers or absorb them into your own margin.

The decision on how to handle transaction costs depends on various factors such as your volume of transactions and average order value. If your order value is high, you may be able to absorb these costs without much impact on your profitability. However, for most companies with thin margins, this can be a significant challenge.

The problem lies in the fact that many companies are unaware of the actual transaction costs associated with different payment methods. While they may know the cost for Ideal payments, other payment methods like Visa, MasterCard, and American Express have their own transaction costs. This lack of clarity can lead to unexpected financial consequences.

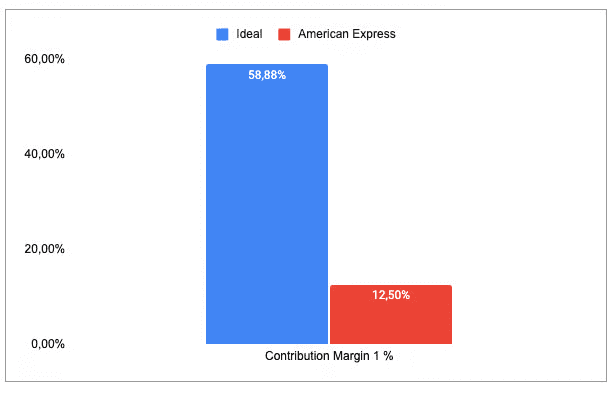

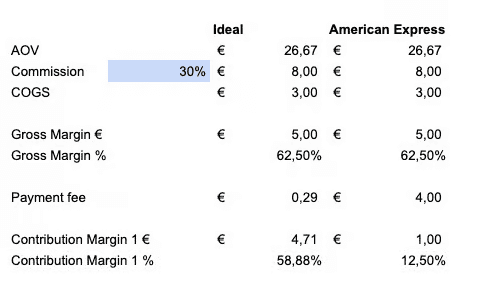

Consider the example of accepting credit card payments. If your platform charges customers 29 cents for an Ideal payment, but the transaction cost for an American Express payment is around 4 euros per order, you could be eating away a significant portion of your margin.

For instance, if you have a commission of 8 euros per order and a low-price, high-volume business model, the transaction costs alone could consume 50% of your margin.

To avoid such detrimental effects on your profitability, it is crucial to have a clear understanding of your transaction costs. Creating a special GL account or a dedicated line in your profit and loss statement can help you track and analyze these costs effectively. By having a comprehensive view of your unit economics, you can make informed decisions and ensure the sustainability of your business.

It is important to note that while Ideal payments may be the most common, there will always be customers who prefer to pay with credit cards. Understanding the ratio of Ideal transactions to credit card transactions is essential. For example, if the transaction costs for Ideal are 29 cents and for American Express are 4 euros, it would take approximately 14 Ideal transactions to equal the transaction cost of one American Express payment. This discrepancy highlights the potential impact on your margin and emphasizes the need for careful consideration.

Conclusion

In conclusion, transaction costs play a significant role in the profitability of e-commerce startups. By gaining a clear understanding of these costs and their impact on your margins, you can make informed decisions and ensure the financial health of your business. Remember, it's not just about the average transaction, but also about the variety of payment methods and their associated costs.